From Moscow to Markets: Russian Oil in the Global Supply Chain

Analysis

By Usanas Foundation

- Background

Russia, the world’s second-largest crude oil producer with an output of around 9.5 million barrels/day (nearly 10% of global demand), is also the second-largest exporter, shipping about 4.5 mb/d of crude and 2.3 mb/d of refined products.

In March 2022, fears of Russian oil being pushed out of the market and the consequent dislocation of traditional trade flows drove Brent crude prices to soar to US$137 per barrel. If India were to stop buying Russian crude oil today, global crude prices could jump to over 200 dollars a barrel for all global consumers. The current rhetoric of some US officials labelling India as “funding the Russian war machine” is devoid of a basic understanding of energy supply chains, decisions taken by the previous US administration, the G7/EU and the hypocrisy of carve-outs which have been given by different EU nations to themselves.

Russian oil has never been sanctioned by the US/EU/G7, unlike Iranian and Venezuelan Oil (which is not bought by our oil PSUs, unlike the Chinese companies who buy sanctioned Iranian and Venezuelan oil also). Russian oil was subjected to a G7/EU price-cap mechanism designed to limit Russia's revenue and prevent "war profiteering" while ensuring global supplies continued to flow. India has followed the price cap mechanism. India’s energy decisions were not just about national interest but were a contribution to global stability. India’s pragmatic approach kept oil flowing, prices stable, and markets balanced, while fully respecting international frameworks.

- Who buys Russian Energy

The share of Russian crude oil in India's imports rose sharply from less than 0.2% in 2021-22 to around 36% in the last financial year, amounting to over US$50 billion in 2024-25 and comprises 73% of our bilateral trade with Russia. A table with details of energy purchases by India, the EU, China, Turkiye and Brazil is listed in Annexure.

Crude: India is not alone in buying Russian oil; in fact, between 5 December 2022 and mid July 2025, China accounted for 47% of Russia’s total crude oil exports, followed by India at 38%, while the European Union (EU) and Turkey each accounted for 6%

Petroleum products: India does not buy petroleum products from Russia. During this period, Turkey (a member of NATO) emerged as the largest importer of Russian refined petroleum products, purchasing 26% of total exports, followed by China at 13% and Brazil at 12%.

Natural Gas: EU, despite its sanctions rhetoric, was the largest importer of Russian liquefied natural gas (LNG) during this period, buying 51% of Russia’s LNG exports, followed by China at 21% and Japan at 18%. Similarly, for pipeline gas, the EU remained the top buyer with a 37% share, followed by China (30%) and Turkey (27%).

For the month of June 2025 alone, the EU was the fourth-largest buyer of Russian fossil fuels, after China, India, and Turkey. The five largest EU importers collectively paid around €1.2 billion for these imports. Notably, over 72% of these imports were natural gas, which remains unsanctioned by the EU and is primarily delivered either through pipelines or in liquefied form. Key recipients of Russian LNG included Hungary, Belgium, France, Slovakia, and the Netherlands.

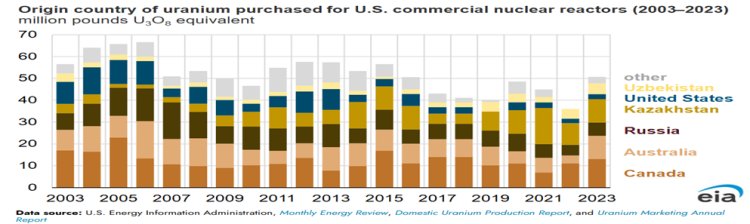

Critical Minerals: In 2024, both the USA and Russia imposed a ban on the export of enriched Uranium from Russia to US, with some waivers. However, the US continue to import Uranium from Russia and has imported around US$596 million of Uranium from Russia during Jan – May 2025.

Criticism of India’s crude oil policy is selective and overlooks broader realities. Many sanctioning jurisdictions continue to import Russian hydrocarbons. In fact, the EU’s carve-outs in sanctions against Russia, while publicly justified on humanitarian, economic, or security grounds, are self-serving in nature.

Under EU exemptions, Russian crude continues to be supplied via the southern Druzhba pipeline to Hungary, Slovakia, and the Czech Republic. Additionally, the Sakhalin-2 crude-to-Japan exemption allows seaborne Russian oil shipments to Japan, valid until June 28, 2026. This double standard of the EU was even visible under the EU’s 18th Sanctions Package, putting an Import ban on refined oil products derived from Russian crude; however, exceptions were made for Canada, Norway, Switzerland, the UK, and the US regarding the import ban on refined petroleum products derived from Russian crude.

- India’s Role in Stabilizing Global oil Prices

Western countries see buying Russian crude by India as undermining the sanctions regime — assuming India is effectively providing Russia with revenue despite Western efforts to isolate Russia economically.

However, India's purchase from Russia has helped in mitigating the supply disruption and thereby preventing a sharper global price spike. Indian companies buy Russian crude through international traders, not directly from Russian entities. These purchases are executed below the G7-imposed price cap, ensuring compliance with global frameworks and preventing excess revenue flow to the Russian state. Thus, India’s purchases do not contribute to war profiteering or fund the ongoing conflict.

Further, India's purchases have remained fully legitimate and within the framework of international norms. Had India not absorbed discounted Russian crude combined with OPEC+ production cuts of 5.86 mb/d, global oil prices could have surged well beyond the March 2022 peak of US$137/bbl, intensifying inflationary pressures worldwide.

- India's proactive measures were encouraged by the USA

- In November 2022, U.S. Treasury Secretary Janet Yellen remarked: "The United States is happy for India to continue buying as much Russian oil as it wants, including at prices above a G7-imposed price cap mechanism, if it steers clear of Western insurance, finance and maritime services bound by the cap."

- In March 2024, Mr. Amos Hochstein, President Biden's energy and global infrastructure adviser, said, "At the end of the day, my goal is not to take it off the market, I'm not looking to take these tankers, take the crude, the product, off the market"

- In February 2024, U.S. Assistant Secretary of State Geoffrey Pyatt acknowledged India’s role in stabilizing global energy markets: "India has played a key role in efforts to stabilize global energy markets through its purchases of Russian crude."

- In May 2024, US Ambassador to India Eric Garcetti admitted that India bought Russian oil because the US wanted somebody to buy Russian oil. "The US allowed the purchase to take place to ensure the prices did not go up globally," he added. Garcetti also highlighted that due to this arrangement global oil prices didn't shoot up and "India delivered on that."

Annexure

(Source: Centre for Research on Energy and Clean Air)

- Value of Russian Fossil Fuel import (Dec 2022* – 17 July 2025)

|

Country |

Oil EUR billion |

Coal EUR billion |

Gas EUR billion |

Total EUR billion |

|

China |

142.56

(~US$ 164.49billion)

|

28.32

(~US$ 32.78 billion) |

26.22

(~US$ 30.36 billion) |

197 |

|

India |

107.22

(~US$ 124.06 billion) |

12.30

(~US$ 14.24 billion) |

0.23

(~US$ 0.27 billion) |

120 |

|

Türkiye |

55.70

(~US$ 64.46 billion) |

7.27

(~US$ 8.42 billion) |

17.89

(~US$ 20.70 billion) |

80 |

|

EU |

21.07

(~US$ 24.39 billion) |

0.00 |

42.54

(~US$ 49.27 billion) |

63 |

|

Brazil |

17.72

(~US$ 20.53 billion) |

0.33

(~US$ 0.38 billion) |

0.03

(~US$ 0.03 billion) |

20 |

- Russia’s Current Top Fossil Fuel Export Destinations (June 2025)

|

Country / Region |

Share of Export Revenue |

Value (EUR) |

Value (US$) |

Key Commodities |

|

China |

38% |

EUR 5.4 billion |

~US$ 6.25 bn |

Mostly crude oil (EUR 3.5 bn = US$ 4.62 bn) |

|

India |

31% |

EUR 4.5 billion |

~US$ 5.21 bn |

Crude oil accounted for 80% (EUR 3.6 bn = ~US$ 4.17 bn) of these imports. |

|

Türkiye |

16% |

EUR 2.3 billion |

~US$ 2.67 bn |

Oil products (EUR 1 bn =US$ 1.15 bn) |

|

European Union |

10% |

EUR 1.47 billion |

~US$ 1.70bn |

LNG (EUR 728 mn = US$ 0.84 bn), rest mostly crude oil |

|

Brazil |

3.1% |

EUR 443 million |

~US$ 0.51 bn |

Mostly oil products |

- Uranium imports from Russia: In 2024, both the USA and Russia banned on export of enriched Uranium from Russia to the US, with some waivers. However, US has continued to import Uranium from Russia so far. As per reports US imported around US$596 million of Uranium from Russia during Jan – May 2025. However, Major sources of US Uranium imports are Canada, Australia and Kazakhstan.

*EU, UK, US and G7 nations implemented a near-total ban on the import of seaborne Russian crude oil, effective December 5, 2022—pipeline deliveries were exempted.

Disclaimer: This paper is the author's individual scholastic contribution and does not necessarily reflect the organization's viewpoint.